Introduction: Why Auto Insurance Quotes in Utah Matter

I remember the first time I looked for a car insurance quote in Utah. I had just moved to Salt Lake City, and to be honest, I didn’t know where to start. I thought it would be quick and easy – but within minutes I was inundated with numbers, terms, and options. It was overwhelming.

But what I quickly learned is this: Comparing quotes is one of the smartest ways to save money – especially in 2025, when Utah auto insurance rates are increasing faster than ever. I noticed that the price and coverage of the same car can vary by hundreds of dollars depending on the company. That’s when I realized I wasn’t just shopping for a policy – I was making a financial decision that could affect me for years to come.

The good news? There are still ways to find affordable car insurance in Utah if you know where to look. And that’s exactly what this guide is for – to help you make smart, easy choices that save you money and bring you peace of mind.

Quick Reference for 2025:

- According to the Utah Insurance Department, insurance premiums have gone up by an average of 9–12% since 2023 due to inflation and increased repair costs.

- But many drivers save up to $500/year just by comparing at least 3 different quotes before choosing.

Source: Utah Insurance Department – 2025 Rate Updates

Source: NAIC – 2025 Auto Insurance Trends

How to Get the Best Auto Insurance Quotes in Utah

When I first started looking for car insurance quotes in Utah, I thought I would just pick the cheapest option and move on. But that approach ended up costing me more in the long run. Over time, I learned how to get better coverage for less money – just by knowing what to ask for and where to look. Today, here’s exactly how I do it, and how you can too.

Step-by-Step Guide to Getting Quotes That Actually Save You Money

1. Start by Knowing What You Need

Before you visit any website or call an agent, take a moment to think about your needs:

- Do you want minimum coverage to stay legal?

- Or do you want full protection with extras like roadside assistance?

Personally, I always write down my must-haves on paper before I begin. It keeps me focused and saves time when comparing offers.

2. Use Online Tools That Compare Multiple Companies

This is where the magic happens.

Instead of going to each company one by one, I use online comparison tools. These websites aggregate rates from multiple insurance providers so you can compare car insurance in Utah in one place.

I’ve used tools like:

They’re fast, free, and show side-by-side quotes. I usually compare at least three quotes before choosing one.

2025 Tip:With average Utah insurance rates increasing by 9-12% in the past year (Source: Utah Department of Insurance, 2025), comparing quotes can save you $300-600 a year.

3.Try Company Apps or Speak to a Local Agent

Sometimes, going direct can also help—especially if you have a unique situation like:

- A teen driver

- A high-risk history

- A custom or classic car

In these cases, I’ve had better luck contacting local Utah auto insurance agents or using apps from companies like GEICO, Progressive, or State Farm. They sometimes offer discounts not found on comparison sites.

I once saved $150 a year by bundling auto and renters insurance after calling my local State Farm office in Provo.

4.Be Honest and Accurate With Your Info

This part is important.

To get accurate car insurance quotes in Utah, you’ll need to provide:

- ZIP code

- Your car’s make, model, and year

- Driving history

- Current insurance (if any)

Mileage and how often you drive

If you guess or provide incorrect information, the quote may seem cheap now—but you’ll face a higher premium later. I always double-check my information before submitting.

5. Look Beyond the Price

It’s a lesson I learned the hard way.

I used to go with the cheapest quote without reading the fine print—and when I needed help after a minor accident, the customer service was terrible. Now, I check:

- Customer reviews

- Claims satisfaction

- What’s included vs. what’s not

Price matters—but peace of mind matters more. And sometimes, paying a little more saves a lot of trouble down the road.

What Impacts Auto Insurance Rates in Utah?

When I first moved to Utah and bought a car, I thought insurance costs would be the same for everyone. But after getting quotes, I realized that’s not how it works. Car insurance rates in Utah can vary a lot depending on your situation—even if you drive the same car with someone else. Here’s what I’ve learned from personal experience.

1. Your Age and Driving Experience Matter

My younger cousin just got his license. When it turned out his rental price was double my salary, he was shocked. Why? Young drivers are seen as high risk, especially if they are under 25. Older drivers, especially those with good records, usually pay much less.

In 2025, drivers under 25 in Utah pay up to 35% more on average for auto insurance than older drivers.

Source: Utah Insurance Department – 2025 Rate Trends

2. Where You Live in Utah Can Raise or Lower Your Rates

Your zip code affects your quote more than you might think. I live in Sandy, and my friend in West Valley City pays significantly more—even though we have the same car and record. That’s because areas with higher accident, theft, or traffic violations tend to have higher rates.

So if you live in a busy area like Salt Lake City, you could end up paying more than in a quieter town like Logan or Cedar City.

3. Your Driving History Tells a Story

A clean record can result in huge savings. I had a speeding ticket a few years ago, and my premiums went up almost immediately.Your car rental may increase due to various reasons such as accidents, insurance claims you make, and traffic violations. Insurance companies want to know: Are you a safe driver?

Even a small at-fault accident can raise your premium by 20–40% in Utah.

Source: NAIC 2025 Auto Insurance Data

4. The Car You Drive Also Plays a Big Role

I drive a midsize sedan with a good safety rating—and that helps keep my rates low. But my brother, who drives a sporty coupe, makes a lot more. Why? Cars that are expensive to repair or are more likely to be stolen tend to cost more to insure.

On the other hand, if your car has advanced security features or anti-theft features, you may be able to get a percentage discount on the rental.

5.How Much You Drive (and Why) Affects the Price

When I was working from home in 2020, I didn’t use my car much. So I called my insurance provider and asked for a low mileage discount—and it worked. In Utah, how often and how far you drive each week matters. If you use your car for daily commuting or business, rates can be higher than if you only drive on the weekends.

6. The Coverage You Choose Changes Everything

If you need minimal car insurance in Utah (liability only), your rates will be lower. But I personally prefer full coverage car insurance in Utah—which includes collision and comprehensive—because it gives me peace of mind.

Yes, I pay more now, but if I ever hit a deer (which isn’t rare in Utah), I know I’ll be covered.

In 2025, the average cost of full coverage in Utah is around $1,560 per year, while minimum coverage averages about $720.

Source: ValuePenguin Utah Auto Insurance Report, 2025

Cheap Doesn’t Mean Bad: Finding Budget-Friendly Options

When I first started comparing car insurance, I focused solely on price. I just wanted the cheapest car insurance in Utah that I could get. But a few years ago, I made a mistake that changed my perspective on insurance.

The Day I Learned the Hard Way

I chose the lowest price—just to save money. A few months later, my car was hit in a parking lot. There were no witnesses. No one came forward. And the worst part? My cheap plan didn’t include the coverage I needed. I paid out of pocket.

That day taught me this: Cheap doesn’t mean good. It just means cheap. What you really want is affordable car insurance in Utah that still protects you when it matters.

How I Balance Price and Protection

Here’s what I do now when shopping for car insurance:

1. I Always Check What’s Included

A low monthly rate can look tempting—but I read the fine print. Does it include collision? Roadside assistance? Rental reimbursement? These small details matter a lot if something goes wrong.

2.I Ask About Discounts Every Time

Last year, I saved $120 by bundling my auto and renter’s insurance. Utah insurers also give discounts for:

- Safe driving

- Paying annually instead of monthly

- Low mileage

- Taking a defensive driving course

Sometimes, the agent won’t mention these unless I ask—so I always ask.

3. I Compare Quotes Once a Year

Every year, I check at least three quotes. Prices change, even if nothing about me has. In 2025, Utah’s insurance rates shifted due to new accident stats and storm patterns. Staying with the same company out of habit can cost you hundreds.

Data: Utah drivers saved an average of $465 per year in 2025 by comparing policies annually.

Source: Utah Insurance Department

4. I Consider Usage-Based Insurance

Because I work remotely, I drive less than I used to. I joined a usage-based plan with Allstate last year. It tracks my mileage and driving habits. Result? My rate dropped by 19%—with no loss in coverage.

5. I Choose Value, Not Just the Lowest Price

It’s easy to chase the lowest number. But now, I think long-term. Will this policy help me if I’m stranded in the snow? Or if my car gets stolen? I don’t want a policy that disappears when I need it.

I tell my friends all the time:

“I look for value—not just a low price. A few dollars saved now isn’t worth thousands lost later.”

Final Thought

Yes, you can get cheap auto insurance in Utah. But cheap shouldn’t mean risky. With the right company and smart decisions, you can get affordable protection—without cutting corners.

Quick Tips Recap:

- Review what’s covered

- Ask about every possible discount

- Compare quotes yearly

- Look into pay-per-mile programs

- Pick protection, not just price

Trusted Sources:

- Utah Insurance Department – 2025 Report

- NerdWallet – Car Insurance in Utah 2025

- Consumer Reports – Insurance Guide 2025

Minimum vs. Full Coverage: What’s Right for You in Utah?

Whether you choose minimum coverage or full coverage car insurance in Utah is not just about price. It’s about what fits your life best.

What Is the Minimum Required Car Insurance in Utah?

In Utah, the law says every driver must have at least:

- $25,000 for injury to one person

- $65,000 for injury per accident

- $15,000 for property damage

- $3,000 Personal Injury Protection (PIP)

This is called minimum car insurance in Utah. It’s the legal bare minimum to be on the road.

Good if:

- Your car is older or fully paid off

- You don’t drive far or often

- You’re on a tight budget

Keep in mind: If an accident causes more damage than your policy covers, you could be paying the rest out of pocket.

What Is Full Coverage Insurance?

Full coverage car insurance in Utah usually includes:

- Liability (the legal minimum)

- Collision (pays for your car if you hit something)

- Comprehensive (covers things like theft, hail, or fire)

I had full coverage when I bought my first new car. Just two months later, someone hit me in a parking lot. Luckily, my policy paid for the damage—even though we never found the other driver. I would’ve had to pay thousands without full coverage.

Good if:

- Your car is newer or financed

- You want more peace of mind

- You can’t afford surprise repair bills

Which One Is Right for You?

Here’s how I look at it:

| Question | If Yes → Consider |

| Is your car worth less than $3,000? | Minimum Coverage |

| Is your car new, leased, or financed? | Full Coverage |

| Do you park on the street or drive a lot? | Full Coverage |

| Are you trying to save short-term and okay with more risk? | Minimum Coverage |

2025 Update:

In 2025, more Utah drivers are opting for full coverage because of rising repair costs and unpredictable weather damage.

Source: Utah Insurance Department – 2025 Driver Coverage Report

The Role of Discounts: How I Lowered My Premium

When I first started shopping for car insurance in Utah, I didn’t realize how many car insurance discounts were available. Once I learned about them and asked my provider, my premiums went down – without reducing my coverage.

Common Auto Insurance Discounts in Utah (2025)

Here are some discounts I found most helpful:

- Safe Driver Discount – No accidents or tickets? You’ll likely save.

- Bundling – I combined my home and auto policies with the same company.

- Good Student Discount – My cousin saved money just for getting B’s in college.

- Low Mileage Discount – I work from home, so I qualified easily.

- Multi-Vehicle Discount – We added my wife’s car to the same policy.

- Anti-Theft Device Discount – My car has a factory-installed alarm.

- Pay-in-Full Discount – I paid for 6 months upfront and saved more.

- Telematics Program – I signed up for one that tracks driving habits with an app. Turns out, I’m a careful driver!

Tip: Every insurer offers different discounts. Always ask. You might be missing out.

My Personal Example

In 2023, I was paying over $140 per month for my policy. After reviewing the policy with a local agent and adding just three discounts — bundling, safe driver, and low mileage — I brought it down to $98 per month by the start of 2024. Now, in 2025, I’m still paying less than $100 with full coverage.

I didn’t change my coverage or provider. I just asked the right questions.

What You Should Do

If you haven’t called your provider recently, do it now. Ask,

“Can you review which discounts I already have—and which I might qualify for?”

Even if you only get one or two, the savings can really add up over the year.

2025 Update

According to the Utah Insurance Department, more drivers are reducing costs through auto insurance discounts in Utah rather than switching companies.

Final Tip : Discounts aren’t just for perfect drivers. Some are based on lifestyle, habits, or how you pay. Take a few minutes to ask—you could save a lot more than you expect.

Best Practices to Compare Car Insurance in Utah

When I bought my second car in 2024, I made a mistake—I rushed into a policy without comparing options. I thought I got a good deal, but months later I realized I was paying more for less coverage. Since then, I always take the time to compare car insurance in Utah, and I’ve saved hundreds.

Why Comparing Policies Matters

No two insurance companies are the same. Even if the coverage looks similar, the price, service, claims process, and discounts can vary a lot.

A friend of mine and I both drive similar SUVs. Same age, same city. But because she didn’t compare offers, she paid $40 more a month for nearly identical coverage.

That’s when it hit me—comparison isn’t just smart, it’s necessary.

What to Watch Out For

When you compare car insurance in Utah, don’t just look at the price. These small details matter:

- Deductibles – A lower premium might mean a higher out-of-pocket cost.

- Coverage limits – Make sure you’re not underinsured.

- Hidden fees – Ask about cancellation, reinstatement, or billing fees.

- Exclusions – Some policies won’t cover rental cars or towing.

- Rate changes – Watch for policies that hike rates after 6 months.

Always read the fine print. If something feels unclear, ask.

Tools & Tips I Personally Use

These are the tools I trust and use:

- Policygenius – I like how clean and simple it is. I’ve used it twice now.

- NerdWallet Compare Tool – It shows side-by-side options in seconds.

- Calling local agents – Yes, old school—but sometimes they offer deals not listed online.

- Spreadsheet – I make a simple comparison table: company, price, discounts, extras.

Here’s a tip: Always compare at least 3 quotes before buying. And don’t be shy to negotiate.

Top Utah Car Insurance Companies I Trust

When it comes to Utah car insurance companies, I don’t gamble. I’ve learned to look beyond just price and focus on trust, service, and how easy it is to manage the policy.

Here are a few names that have earned my trust—either from personal use or from people close to me.

- State Farm – Great for Customer Support

I used State Farm for three years. What stood out most? Their local agents in Utah were easy to reach and genuinely helpful when I had a claim. They even walked me through the entire process after a fender bender in Salt Lake City.

Their mobile app is clean and fast. I once uploaded photos after a minor accident right from my driveway—no hassle at all.

- GEICO – Budget-Friendly with Reliable Coverage

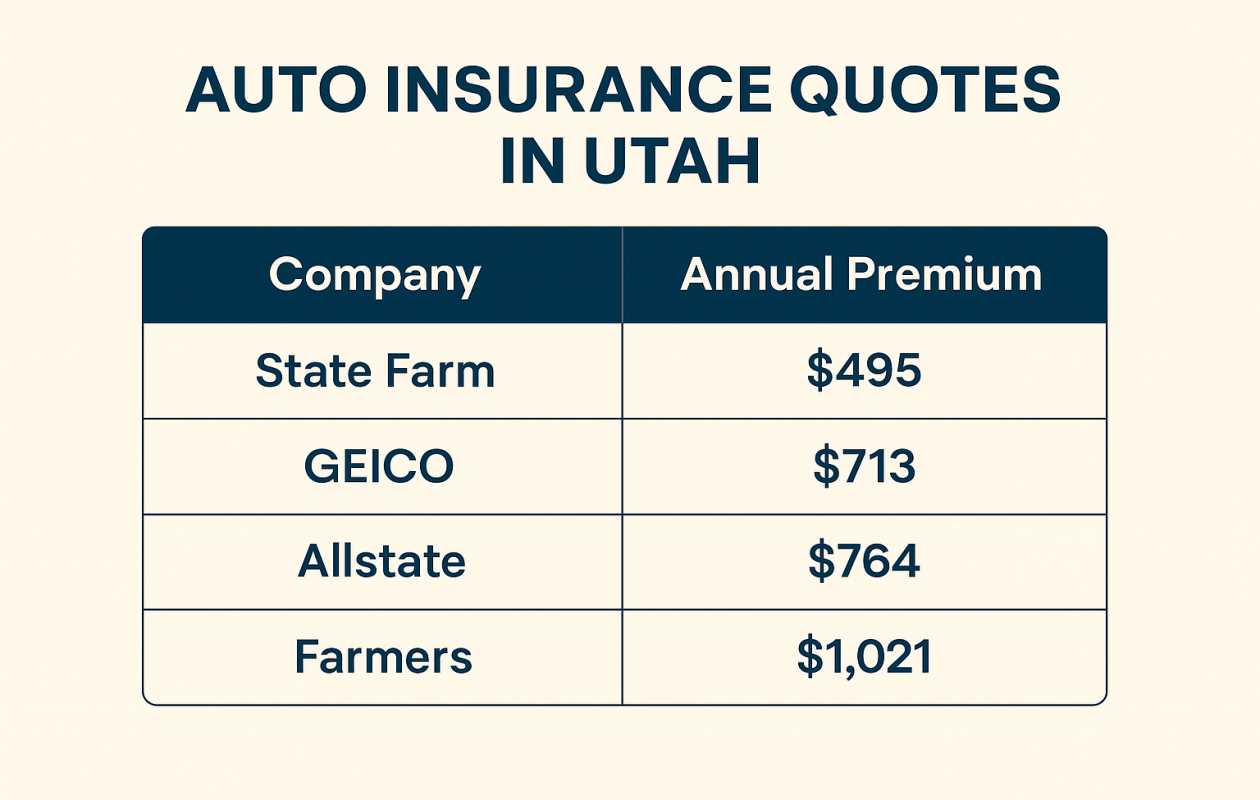

My cousin switched to GEICO last year and cut his bill by almost 30%. For basic and full coverage options, GEICO often comes up with some of the best car insurance rates in Utah.

He likes the online tools—especially how easy it is to adjust coverage or add a vehicle.

- Progressive – Best for Tech & Tracking Discounts

Progressive offers a usage-based program called Snapshot. A friend of mine used it and saw a nice discount just for driving safely over 6 months.

They’re known for clear pricing and solid mobile features, which are great if you’re someone who prefers managing everything digitally.

Why These Stand Out

- Fast Claims – Speed matters when something goes wrong.

- Strong Local Support – Helpful Utah-based agents make a real difference.

Affordable Options – Especially when you bundle or use safe-driving programs.

My Advice

When choosing the best car insurance in the state of Utah, consider beyond what is advertised. Talk to locals. Read real reviews. And always get at least three quotes.

Everyone’s needs are different – but for me, it’s about finding the right balance between price, support, and trust.

Sources:

- Utah Insurance Department – insurance.utah.gov

- J.D. Power 2025 U.S. Auto Insurance Study

- Consumer Reports (2025 data)

Common Mistakes to Avoid When Shopping for Auto Insurance

When I bought my first car, I made a common mistake: I bought the cheapest policy and didn’t ask any questions. A year later, I realized I was one accident away from a huge out-of-pocket expense. That experience taught me to drive slowly and look carefully before buying.

3 mistakes I saw (and made) that I should avoid.

- Overlooking Coverage Limits

It may seem like a financial advantage to have the state’s minimum mandatory insurance. But in Utah, the minimum insurance may not cover the full cost of a major accident.

For example:

Utah requires at least $25,000 per person for bodily injury liability and $65,000 per accident (source: Utah Department of Insurance). But what if you hurt someone and their hospital bill is $80,000? You’ll have to pay the rest yourself.

My advice: Look at what’s really costing you today – medical bills, car repairs – and choose coverage that protects not just your wallet, but your future.

- Ignoring Policy Extras

Many people skip add-ons like rental car coverage, roadside assistance, or uninsured motorist protection – thinking they’re not necessary.

I made this mistake once. My car broke down in Provo, and I had to pay $180 for a tow because roadside coverage wasn’t included. The $2 per month add-on would have saved me a lot of hassle.

Take a close look at what’s being offered. Some of the extras are very small and could save you a lot in the future.

- Not Updating Personal Info

The cost of car insurance depends on a lot of information:

Where you live, how long you drive, the condition of your car—even your credit in most states.

A friend of mine moved from Ogden to a quieter area of southern Utah and didn’t tell his insurance provider. He was still paying city rates for over a year.

Always update your insurance provider when life changes: a new job, a move, a wedding, even a new car. This can lower your premium or keep your policy in good standing.